Financing is an enormous company in the Philippines, which directly as well as indirectly touches almost every part of the economic climate. With millions of people holding loans worth trillions of pesos, any modern technology that can make even a little enhancement in a company’s returns on the loans they hold, or that can enhance their share in the market, is going to be worth a significant amount of cash.

That is why both developed banks, as well as start-ups in the field, are looking for methods to innovate, and artificial intelligence might permit simply that, such as transaction of Cash Loan Online Philippines. As a matter of fact, the AI Possibility Landscape research reveals that approximately 15% of the endeavor financing increased for AI vendors in the banking market is for providing remedies.

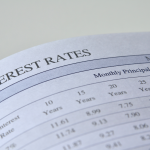

At its core, lending is large data trouble, making it a business normally matched for machine learning. Part of the worth of lending is connected to the credit reliability of the specific or organization that got the financing. The more data you have concerning an individual debtor, and how comparable individuals have paid back financial debts in the past, the better you can examine their creditworthiness.

The worth of a loan is, therefore, tied to evaluations of the value of the collateral, residence, car, service, artwork, etc., the most likely level of the future rising cost of living, as well as forecasts regarding overall financial growth. The guarantee of AI is that, in theory, it can assess every one of these information resources together to create a meaningful decision.

Future Trends for AI in Lending

Making use of device discovering to evaluate alternative data in funding as well as credit score rating is going to raise some personal privacy, moral, as well as legal issues. Many people might not feel comfortable with a firm having access to every one of these sensitive info concerning their life. Also, if all these firms act fairly, the more data they hold, the much more that can be stolen by harmful cyberpunks in a data breach.

Using “big data” likewise runs the risk of business inadvertently or purposely victimizing groups. For example, a program could not deny applications from secured minorities; however, it might refute applications for people that have loads of information marker that simply occur to extremely correlate with those teams.

AI will make the whole process easier and secure beyond any botheration with humans.

For more info on it, please visit the link Crawfort PH.