Analysis of an acute disease brings about a horrendous and stressful time. For a few, one among the immediate concerns is the finance, mainly if there’s additionally a family or different dependants to consider. Since critical illness insurance is typically intended to help relieve some of those monetary concerns.

What is Critical illness insurance?

Critical illness insurance gives monetary security when a genuine disease happens, and an individual can’t figure and acquire a pay. This critical insurance helps cover clinical costs that are usually not covered by other protection approaches. Paid in a single amount gives customers the freedom to utilize the money where its required most – from doctor’s visit expenses to the home loan.

Critical Illness coverage Singapore works by paying for costs resulting from the recovery process of a covered ailment. It doesn’t accept each medical bill yet gives an installment that will be utilized toward any condition recorded on the policy.

Why is critical illness insurance important?

Your disease accompanies other monetary ramifications like your unexpected powerlessness to work. Out of nowhere, your everyday costs became tons more unpleasant. All of this is regularly compounded by the very truth that your accomplice is taking a leave day from work to help you with your doctor’s appointment.

Those bills get the opportunity to become a burden, and surprisingly after you have been given a physician’s approval, you keep on requiring time to get over your medicines. You do not have the opportunity to need to work directly back to handle those bills.

Malignancy isn’t the lone ailment that will have this effect. Critical illnesses like heart condition, diabetes, stroke, epilepsy, and so forth have a similarly extreme physical, mental, and monetary effect.

Can Critical illness insurance give benefits?

Numerous individuals feel they can trust their companions, retirement investment funds, sale of resources, or government help inside the occasion that they wind up out of luck. Yet you would prefer not to be left during a position where you must expect that these alternatives come through for you in an ideal way. As a rule, it simply isn’t reasonable to accept these choices. Also, critical illness insurance furnishes you with extra advantages.

It gives inclusion to costs that are not covered by our medical care framework. Critical illness insurance can help balance some of the costs of specific medication solutions or different therapies that you just would some way or another need to purchase using cash on hand.

You would prefer not to worry about your retirement funds to oblige the costs of your disease. Those investment funds have their motivation, and you would like not to forfeit your future way of life once you need them. Critical illness insurance offers the monetary help you might want to stop the need of plunging into those investment funds so you’ll keep your retirement plans on track.

How critical illness insurance works?

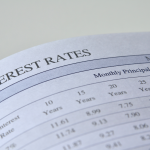

Your policy will be upheld how long you might want your arrangement to last and how you might want to pay. You’ll presumably need to shape sure that you essentially have cover however long you keep on having critical requests on your pay, similar to an outstanding home loan or kids’ schooling charges.

With level policy, you select an installment that addresses your issues and how you might want your cover to run. You’ll at that point pay a comparable sum month to month until your loan closes. You would potentially pick this component if you wanted to help cover general outgoings, any extra wellbeing-related expenses, and other monetary responsibilities.

You can make your policy sum expansion. This recommends that your regularly scheduled installments may rise. However, it guarantees that the installment will not be worthless in the future because of the increase in the average cost for essential items.

With diminishing cover, your policy’s value goes down month to month; however, what you pay remains identical for the length of the policy.

How much policy amount does one need?

Accept the costs you’d had the opportunity to cover if you somehow become sick and couldn’t work. You’ll need to ensure that your family is accommodated on the off chance that you have youngsters, simply on the off chance that you can’t work because of medical issues. Some cover offers monetary security for you and your friends and family.

Or then again, you may have a strategy to frame sure that your home loan is frequently paid off — this is regularly often a prerequisite of home loan applications. The diminishing cover helps to take care of obligations, kind of a reimbursement contract decreasing over the long run.

For additional security, you’ll typically get critical illness insurance and life-affirmation at an identical time. You will be secured against various conditions along these lines and be prepared to pick what extent cover you might want for each approach.

What is the critical insurance cover of a house cleaner?

In Singapore, managers of domestic maids must search for maid insurance, which is an approach that covers any mishaps during work and clinical charges of the maid.

The Ministry of Manpower makes obligatory that each maid assistant should have: $60,000 per annum in close-to-home mishap coverage. Hospitalization inclusion of at least $15,000 per annum, which includes covers inpatient care and surgery costs.

The maid insurance coverage should protect your maid and her family; with installment remuneration should she experience the ill effects of perpetual handicap or demise on account of a mishap. This installment should be made payable to your maid or her recipients.

Conclusion:

One approach to ensure dreams work out is to take a situation in pay security arrangements. Critical illness insurance is one of those strategies that cover the holes in numerous different formats. These arrangements are not difficult to utilize and are for a wide range of people. So, one can quickly get the advantage of using the critical illness insurance cover for their safety and releasing their financial burden.